COVID-19 Business Rates Appeal

Appealing Your Assessment

The Business Rates Services Team at Daniel Watney LLP has served ‘Material Change in Circumstance’ (MCC) appeals on behalf of our clients, seeking reductions in rates liability following the detrimental impact of COVID-19 and the subsequent restrictions on movement.

In short, we are arguing that the rental value of a commercial property, which forms the basis of your business rates assessment, has reduced as a result of the lockdown and consequently your business rates assessment should be reduced accordingly.

We can confirm, properties that did not benefit from the Chancellor’s 100% retail, leisure & hospitality relief scheme, namely offices and industrial premises, are being prioritised.

Assuming the appeals are successful, the reductions in rates liability will be backdated to 23rd March 2020 when the first lockdown came into force.

Time Is Of The Essence

We urge all ratepayers to let us know whether you have acquired any new properties recently, so we may ensure a protective COVID-19 appeal is served in a timely manner.

Most importantly, please be aware that time is of the essence with these types of appeal due to the fact an MCC appeal cannot be served retrospectively i.e. after the COVID restrictions on movement have ended.

The material date of an MCC appeal is the date on which the appeal was served, therefore the Valuation Office Agency are required to take into consideration what was happening at the time the appeal was made. Hence the importance of serving these appeals as soon as possible.

Appeals served after the lockdown measures and restrictions have ceased could therefore be deemed invalid.

How Are Negotiations Progressing?

High level discussions are ongoing between the Rating Surveyors Association (RSA) and the Valuation Office Agency (VOA) to ensure the detrimental impact of the pandemic is accurately reflected in rating assessments that have been challenged in England & Wales.

So far, these meetings have focussed on finding consensus on a number of generic legal principles in order that we might streamline the subsequent discussions in terms of valuation considerations and value effects on particular sectors.

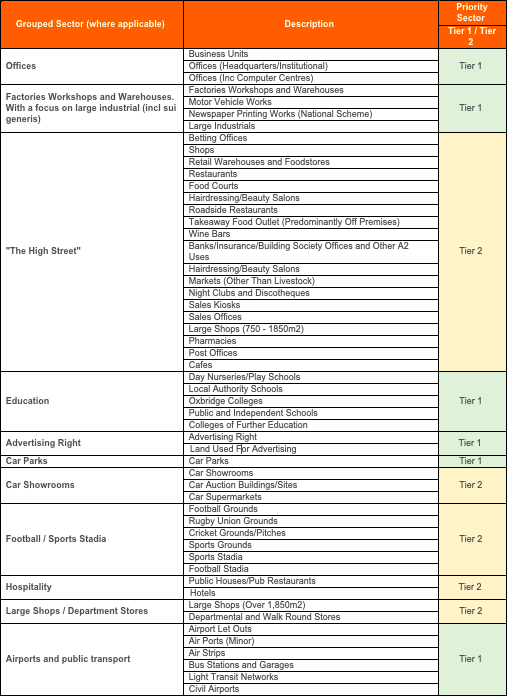

The discussions have identified 12 priority sectors (see table below), which have been categorised as Tier 1 and Tier 2, and the RSA have now formed working groups to discuss those sectors with representatives from the VOA. Some of those discussions are already underway, some have recently commenced, and the remainder will get underway in the New Year.

Proposed Reductions

The main aim of the negotiations is to reach an interim agreement so that businesses who have not benefited from the Chancellor’s 100% retail, hospitality and leisure relief scheme may receive relief themselves via the appeals process.

We can confirm articles published recently in the mainstream and property press which suggest an interim agreement has been reached are a bit premature but as soon as we know anything, we will notify you.

It should be noted the timings of each agreement will vary between sector and locality.

Should Landlords Be Appealing?

Landlords, particularly those with vacant space who are liable to pay business rates, have an equal right of appeal regardless of whether the space is being occupied or not.

We therefore recommend our landlord clients serve protective COVID-19 appeals to mitigate the amount they pay in empty rates for the duration of the pandemic.

Action Points

We would recommend that all ratepayers serve protective MCC appeals citing COVID-19 before the lockdown measures and restrictions on movement come to an end. The reason being is that time is of the essence when serving MCC appeals. Appeals served after the material event has occurred will be invalid and may not be eligible for a backdated reduction.

Accordingly, we ask clients to confirm:

- Whether you have acquired any new properties recently, so we may ensure a protective COVID-19 appeal is served in a timely manner.

- Please confirm the date you acquired the new property and attach a copy rates demand and/or lease agreement.

Book your consultation.

Simply call or email the Daniel Watney team to get started. If you instead prefer us to get in touch with you, then fill this form with your basic details, and you will hear from us soon